This project focused on developing a simulation system dynamics model to formulate stabilising strategies for the largest pension fund in Iran in 2013. The aim was to address the growing long-term liabilities of the fund and provide a decision-support tool for managers. The model incorporated historical data for 10 years and was validated through different methods.

Social security

One of the indicators of growth and development in societies is the development of social security systems, the extent of their coverage, and the level of services provided to the target population. The goal of expanding social security systems is to fill the gap resulting from economic growth policies in order to prevent class disparities and provide welfare services, particularly healthcare services, to all members of society.

However, due to increasing government expenses on one hand and the fluctuations in the economy accompanied by changes in the age structure, the issue of managing pension fund liabilities in providing welfare and social security services has always posed significant challenges for governments.

Governments, adopting linear short-term approaches, always reduce the coverage of healthcare services, increase the retirement age, increase the minimum contributions, etc. Although these linear interventions may offer short-term solutions to the financially imbalanced situation in providing social security services, due to the inefficiency of financial systems associated with these services, particularly in light of the existing demographic changes, it ultimately reveals more intense long-term liability issues.

Let’s learn Systems Modelling together!

I share useful information about Systems Modelling here weekly.

Simulation Model for the Dynamics of Pension Fund Liabilities

This project focused on the largest pension fund in Iran, which covers half of the country’s population, with the aim of creating a decision-making and policy analysis tool for managers in 2013.

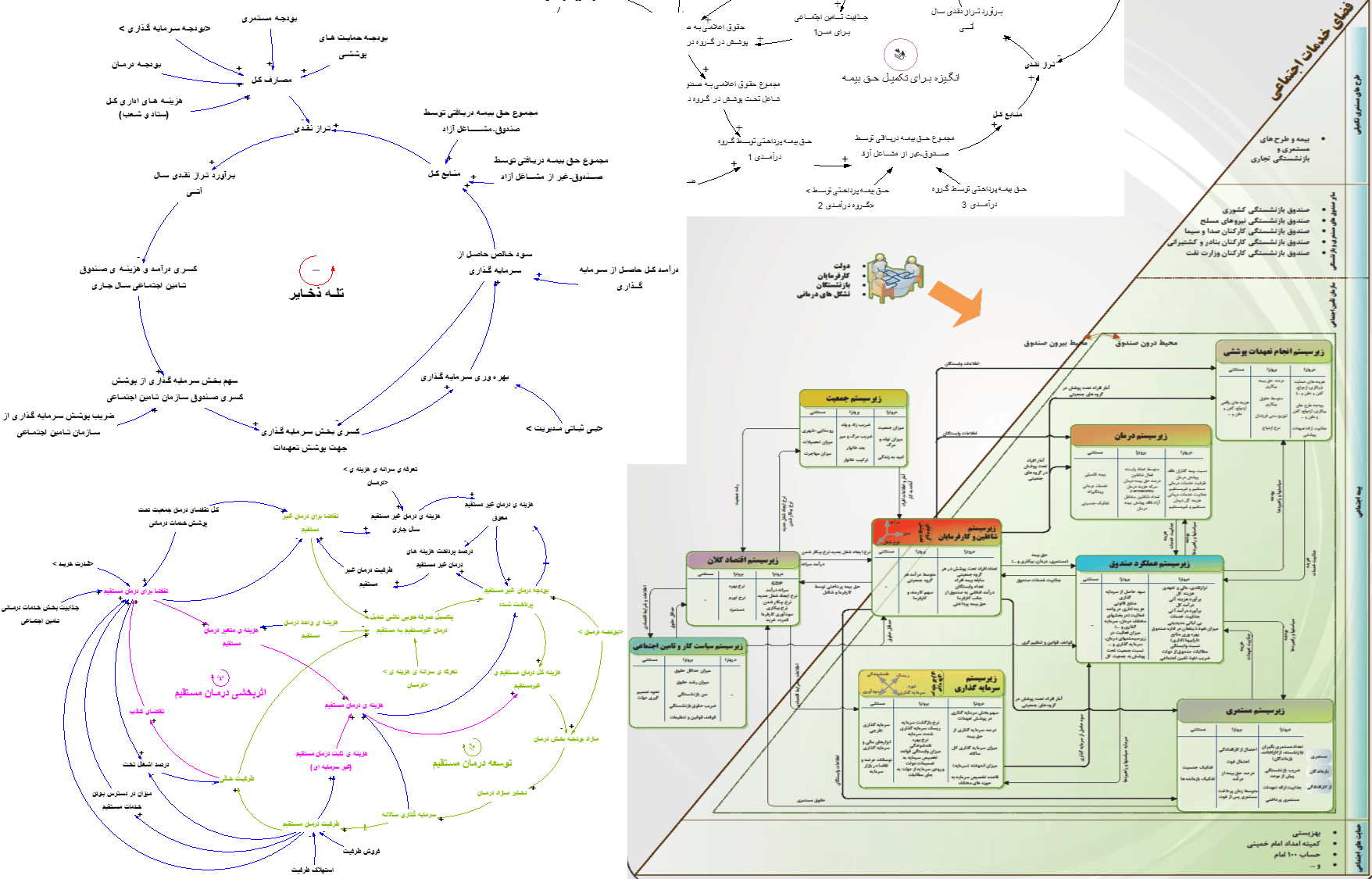

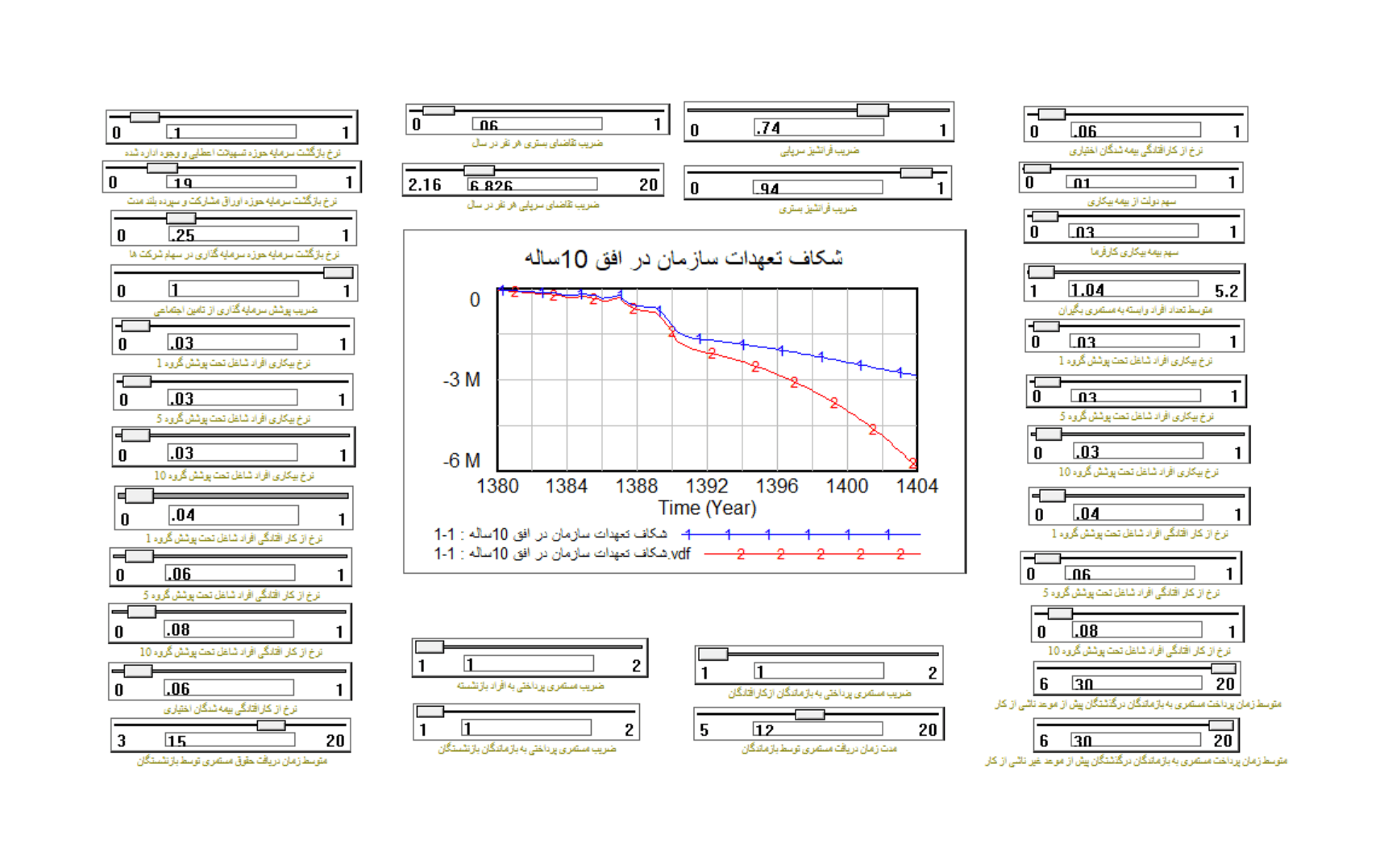

The main problem was the growing trend of long-term liabilities of this pension fund, to the extent that based on its historical trend, the fund would not be unable to meet its long-term liabilities to the pensioners.

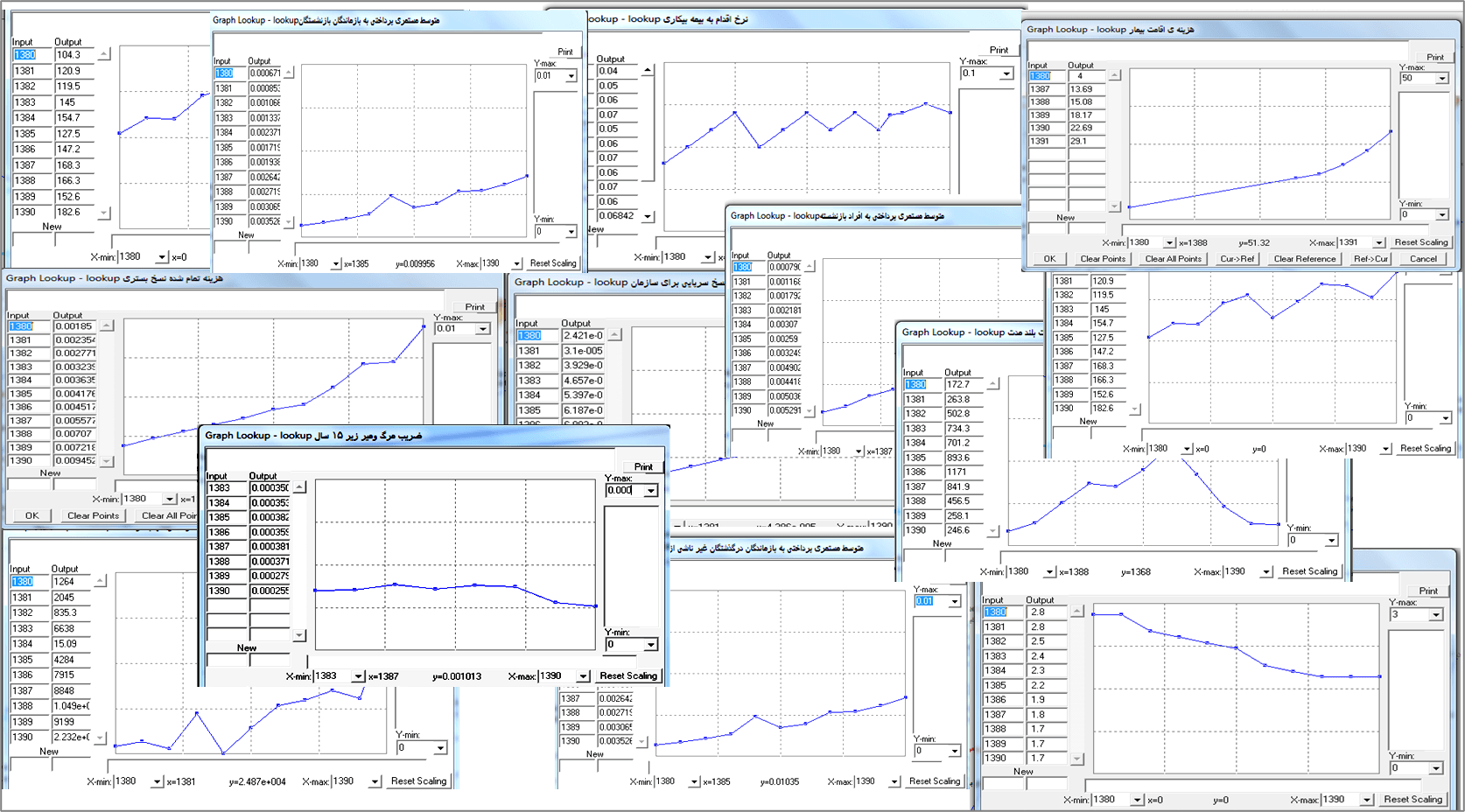

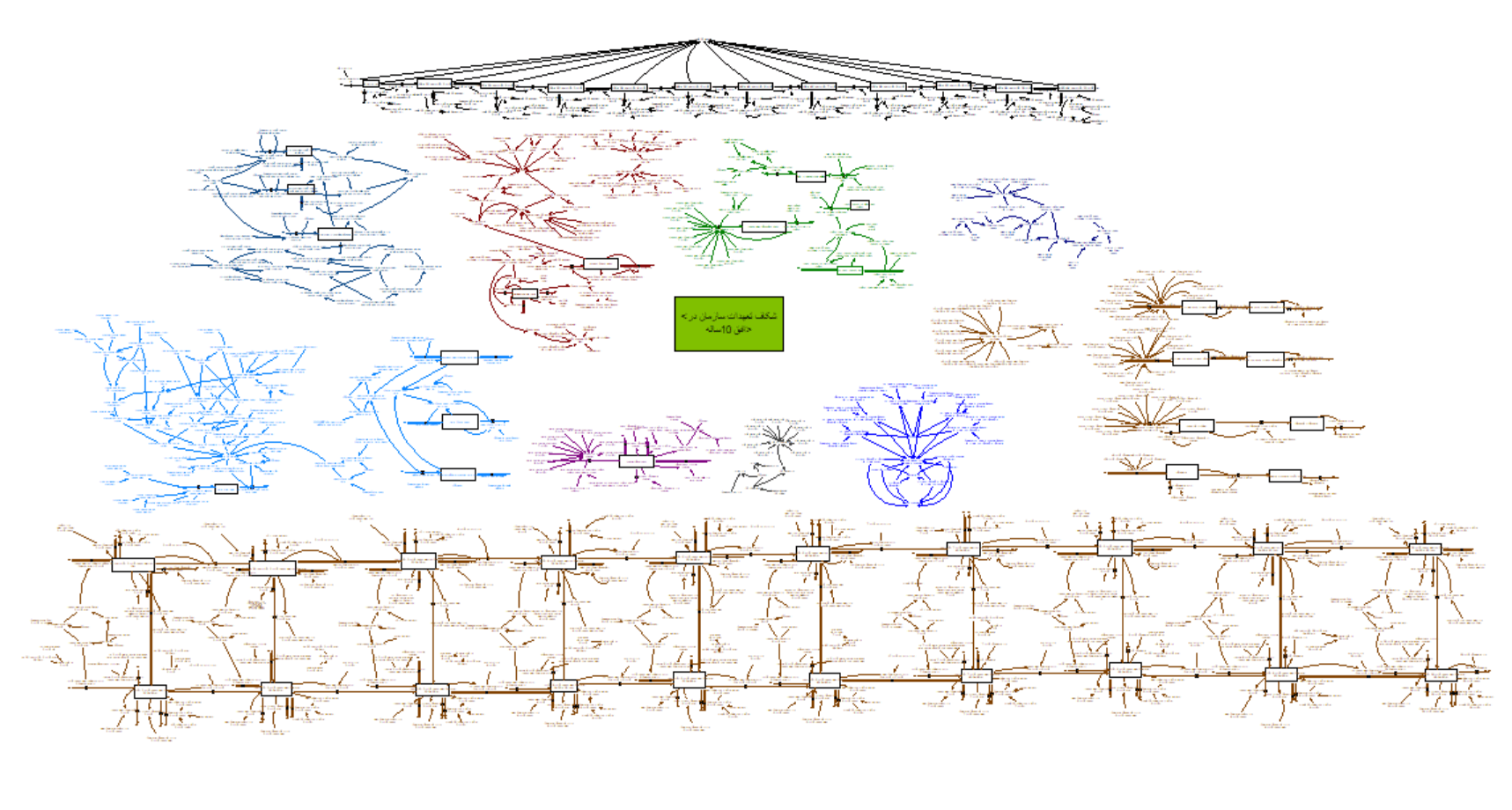

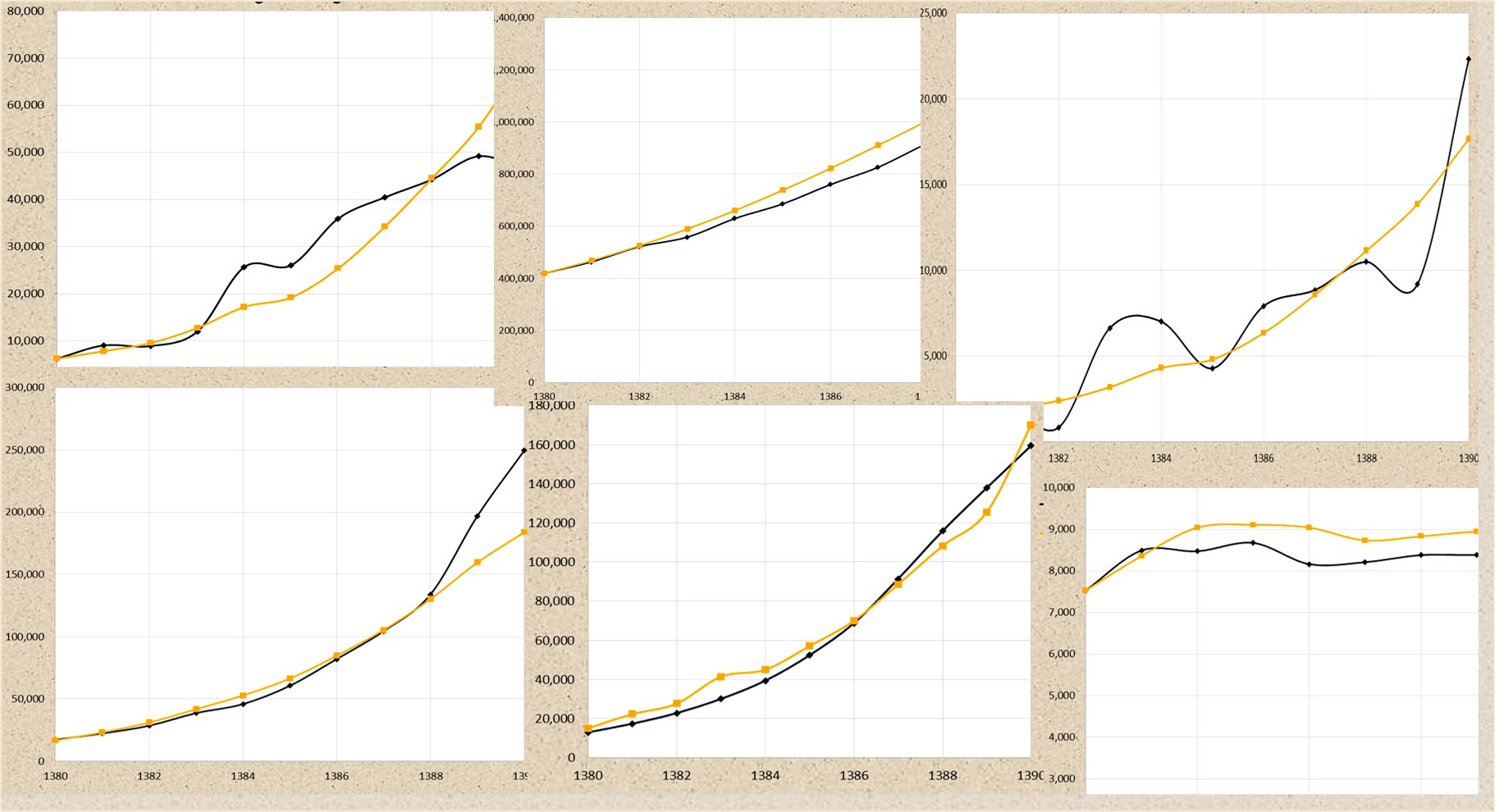

First, a review of the related literature and the previous models was conducted, followed by the creation of a conceptual model of the main dynamics that causes the problem through semi-structured interviews with experts. Project steering committee meetings were held with the participation of managers and experts from various departments of the pension fund. The next step involved collecting the required historical data of the variables used in the model. In this simulation model, historical data from 10 years were used to develop mathematical formulas for the simulation model, and the model was run for 20 years. Certainly, before running the scenarios and interventions, various validation methods were employed to ensure the reliability of the simulation results. Finally, the simulation results were analyzed and examined.

https://www.traditionrolex.com/17

It is worth mentioning that the managers and experts of the pension fund were trained to independently utilize the developed interface/dashboard.

My role in this project:

My role in this project was primarily to oversee the modeling team. However, my responsibilities extended beyond that. They included writing proposals, recruiting modelers, delivering model presentations, conducting training workshops, supervising reports, and facilitating paper publication.

Photo by Towfiqu barbhuiya on Unsplash & Image by vector4stock on Freepik