In this blog, I will summarise my previously published paper that shows how systems modelling can improve managers’ understanding of their business dynamics and feedback structures that impact their decision-making at the strategy formulation level. This paper uses system dynamics (SD) as a modelling and simulation tool applied to a case study of Independent Power Producer (IPP) to align their medium-term project portfolio strategy.

The need for dynamics strategy formulation and implementation

In today’s rapidly evolving business landscape, managers face the constant challenge of aligning their strategies with the dynamic complexities that arise from their business and the rapidly evolving external environment (i.e., local & international markets, economy, etc.). Traditional approaches to strategic planning often rely on linear cause-and-effect thinking, overlooking the intricate feedback loops and time delays that shape the behaviour of real-world systems.

As many organizations shift toward “management by projects”, projects are often the main basis for delivering the organizational strategy. Project portfolio management (PPM) has gained attention that can provide a holistic decision-making framework to align projects with strategy and to ensure resource sufficiency for the project portfolio.

Accordingly, managers require skill sets and toolboxes to support their decision on the PPM level to be aligned with their directional strategy and to investigate how their tactics on the PPM level can affect their organizational performance over time (which finally will affect projects success in a feedback loop).

Application of systems modelling

To address this gap, system dynamics modelling has developed as a powerful tool to support decision-making and strategy formulation, offering a holistic framework that enables managers to dynamically align their strategies based on real-time feedback from their system’s performance.

This approach recognizes that organizational systems are not static entities, but rather dynamic entities influenced by multiple factors; these internal and external factors are coming from different domains making a feedback structure containing time delays and nonlinearity. Using the managerial flight simulators that SD models can provide, managers can simulate different scenarios, predict the outcomes of strategic choices, and evaluate their long-term implications. This empowers them to make informed decisions that align with the evolving dynamics of their industries and organizations.

Let’s learn Systems Modelling together!

I share useful information about Systems Modelling here weekly.

Dynamic project portfolio management

My previously published academic article, titled “A system dynamics investigation of project portfolio management evolution in the energy sector: Case study of an Iranian independent power producer”, presented the potential benefits of system dynamics modelling in portfolio strategy formulation in the energy industry. The study emphasized the need for a more dynamic and feedback-driven approach to project portfolio management (PPM), highlighting the limitations of traditional static portfolio analysis tools.

The application of system dynamics modelling for PPM enables managers to anticipate the consequences of their decisions on the company’s financial performance, human resources, and project-level performance. The energy sector, in particular, can greatly benefit from adopting system dynamics modelling in PPM. The article highlights a case study of an independent power producer, which faced challenges in formulating an appropriate projects portfolio policy. Traditional static portfolio analysis tools failed to consider the dynamic nature of the energy industry, leading to suboptimal strategies and potential financial risks.

By leveraging system dynamics modelling, the company was able to rectify its understanding of the business dynamics and develop new project portfolio strategies. The model showcased how a static analysis approach could misguide managers in planning their portfolio strategies, and demonstrated the crucial role of feedback loops in enhancing PPM in the energy sector. By dynamically adjusting investment priorities based on real-time feedback, the company was able to improve its financial viability and ensure the long-term sustainability of its projects.

The structure of the model

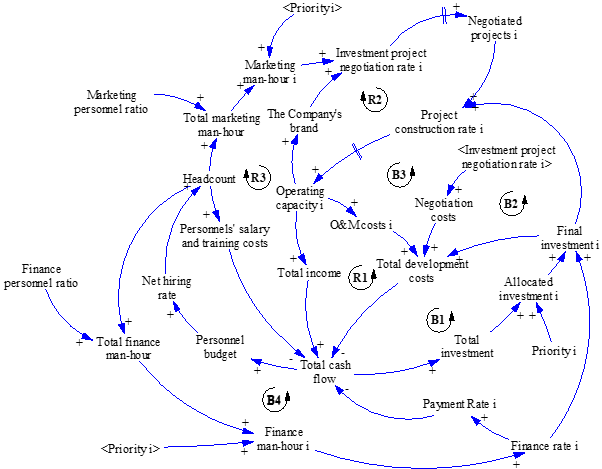

The SD model here includes the following dynamics:

- Power plants capacity development

- Variable development costs

- Brand making

- Negotiation costs (pre-construction costs)

- Human resources hiring

- Human resources costs

- Investment & finance costs

For example, the loop R1 in the following figure depicts the dynamics of capacity development in the company. A considerable share of the (positive) cash flow of the company is allocated to investment in projects. Thus, an increase in cash flow causes an increase in the company’s total investment in the given year. Total investment is allocated to three categories of investment projects, which is shown by the index i (i = 1, 2, 3) for small, medium and big projects. Therefore, the increase rises allocated investment in each category. This increase leads to a rise in the investment project construction rate and operating capacity (with a delay in the construction period) in each category. The more operating capacity the company possesses, the more income it can gain. The increase, finally, would close the loop and cause a rise in cash flow.

To learn more about the case study and the model’s structure, please contact me for more information or read the full article below:

Hosseini, S.H., Shakouri G., H., Kazemi, A., Zareayan, R. and Mousavian H., M. (2020), “A system dynamics investigation of project portfolio management evolution in the energy sector: Case study: an Iranian independent power producer“, Kybernetes, Vol. 49 No. 2, pp. 505-525. https://doi.org/10.1108/K-12-2018-0688

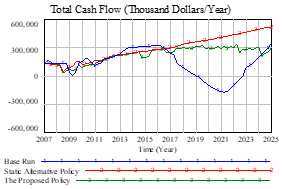

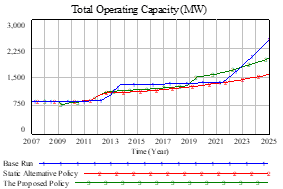

The following figure shows how different strategies can result in different financial and operating power plant capacities (which are crucial outcome variables for the company).

Conclusion

In conclusion, system dynamics modelling has emerged as a valuable approach for dynamic strategy alignment in the energy sector and beyond. By incorporating feedback loops and capturing the inherent complexity of organizational systems, managers can gain a deeper understanding of the consequences of their decisions and dynamically adjust their strategies based on real-time feedback. As organizations strive to thrive in a dynamic and uncertain business environment, system dynamics modelling offers a powerful tool for managers to effectively navigate complexity, optimize their strategies, and drive sustainable success.

The article emphasized the need for greater adoption of system dynamics modelling in industry and the public sector. As organizations increasingly operate in complex and interconnected environments, traditional linear thinking may no longer suffice. System dynamics modelling offers a more accurate representation of the dynamic behaviour observed in real-world systems. It provides decision-makers with a powerful tool to navigate the complexities of their organizations, make informed choices, and dynamically align their strategies to achieve long-term success.

Results of scenario planning showed that practitioners in this industry would consider the following points:

- The consequences caused by feedback from project investment financial requirements on the company’s survival should be taken into account when the company plans its investment program. SMEs, which are always eager to grow fast, sometimes fail to consider apparent feedbacks.

- The effect of project portfolio dynamics should be considered systematically, that is, short-term successes should not mislead a company so that it disregards its long-term success (in this case: having a reliable cash flow).

- The investment portfolio prioritization is a dynamic process that may be revised frequently as per different internal and external situations in a company. Managers should sometimes break their mental model and think more effectively about their decisions’ dynamics.

- Balanced allocation of (financial, human and other organizational) resources about its future consequences is one of the most important factors that should be taken into consideration in investment companies.

- This study showed how using a simulation tool for managerial decision-making can facilitate the process of understanding and learning the mechanisms that affect a company’s current and future performance. It can provide an interactive virtual world to design, apply and evaluate different policy options so that they could be tested by such a simulation laboratory before performing in the real world. This approach facilitates the company’s sustainable development without imposing trial-and-error costs.

Access to my PublicationsHERE

P.S. I benefited from AI technology to write this blog and enhance the quality of the content.

P.S. Photo by Daniel McCullough & Sincerely Media on Unsplash